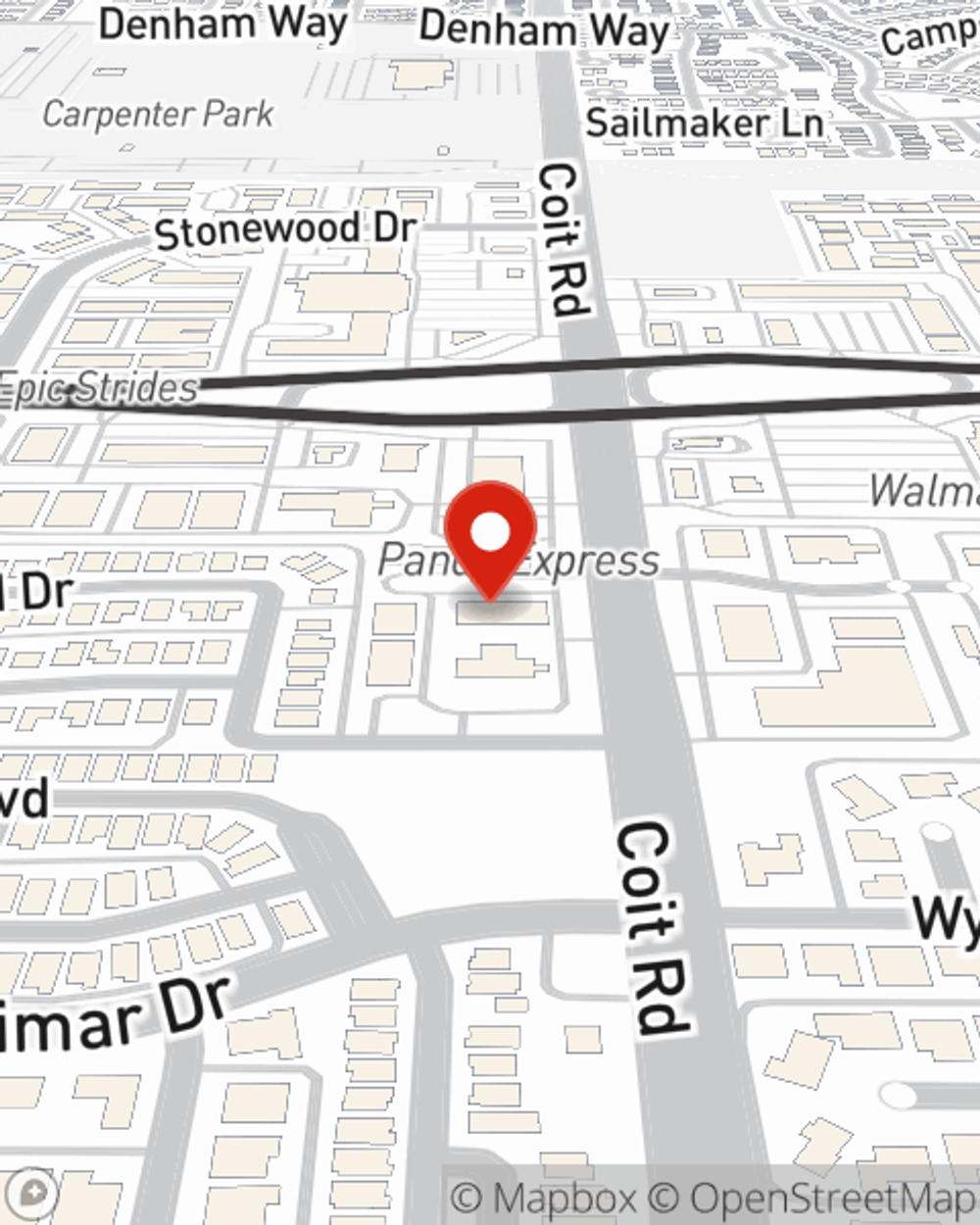

Life Insurance in and around Plano

Get insured for what matters to you

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Plano, Texas

- City Line

- DFW

- Prosper, Texas

- Richardson, TX

- McKinney

- Frisco

- Houston, TX

- New Hope, Texas

- Princeton, Texas

- Missouri City

- Sugar Land

- Carrolton, Texas

- Princeton, TX

- Dallas

- Addison

- South Lake

- Las Colinas

- Trinity Grove

- Sachse, Texas

- Garland, Texas

- The Woodlands

- Anna, Texas

- Celina, Texas

Check Out Life Insurance Options With State Farm

Do you know what funerals cost these days? Most people aren't aware that the mean cost of a funeral in America is $8,500. That’s a heavy burden to carry when they are grieving a loss. If your loved ones cannot cover those costs, they may fall into debt in the wake of your passing. With a life insurance policy from State Farm, your family can maintain their quality of life, even without your income. Whether it maintains a current standard of living, pays off debts or pays for college, the life insurance you choose can be there when it’s needed most by your loved ones.

Get insured for what matters to you

Life won't wait. Neither should you.

Their Future Is Safe With State Farm

Fortunately, State Farm offers various policy choices that can be modified to fit the needs of your family members and their unique situation. Agent Chelsea Terry has the deep commitment and service you're looking for to help you settle upon a policy which can assist your loved ones in the wake of loss.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to see what a company that processes nearly forty thousand claims each day can do for you? Reach out to State Farm Agent Chelsea Terry today.

Have More Questions About Life Insurance?

Call Chelsea at (214) 427-4031 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Chelsea Terry

State Farm® Insurance AgentSimple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.