Business Insurance in and around Plano

Calling all small business owners of Plano!

Helping insure businesses can be the neighborly thing to do

- Plano, Texas

- City Line

- DFW

- Prosper, Texas

- Richardson, TX

- McKinney

- Frisco

- Houston, TX

- New Hope, Texas

- Princeton, Texas

- Missouri City

- Sugar Land

- Carrolton, Texas

- Princeton, TX

- Dallas

- Addison

- South Lake

- Las Colinas

- Trinity Grove

- Sachse, Texas

- Garland, Texas

- The Woodlands

- Anna, Texas

- Celina, Texas

State Farm Understands Small Businesses.

You've put a lot of resources into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a home improvement store, a toy store, an antique store, or other.

Calling all small business owners of Plano!

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

Your business thrives off your passion determination, and having dependable coverage with State Farm. While you lead your employees and do what you love, let State Farm do their part in supporting you with artisan and service contractors policies, business owners policies and commercial liability umbrella policies.

Let's chat about business! Call Chelsea Terry today to see why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

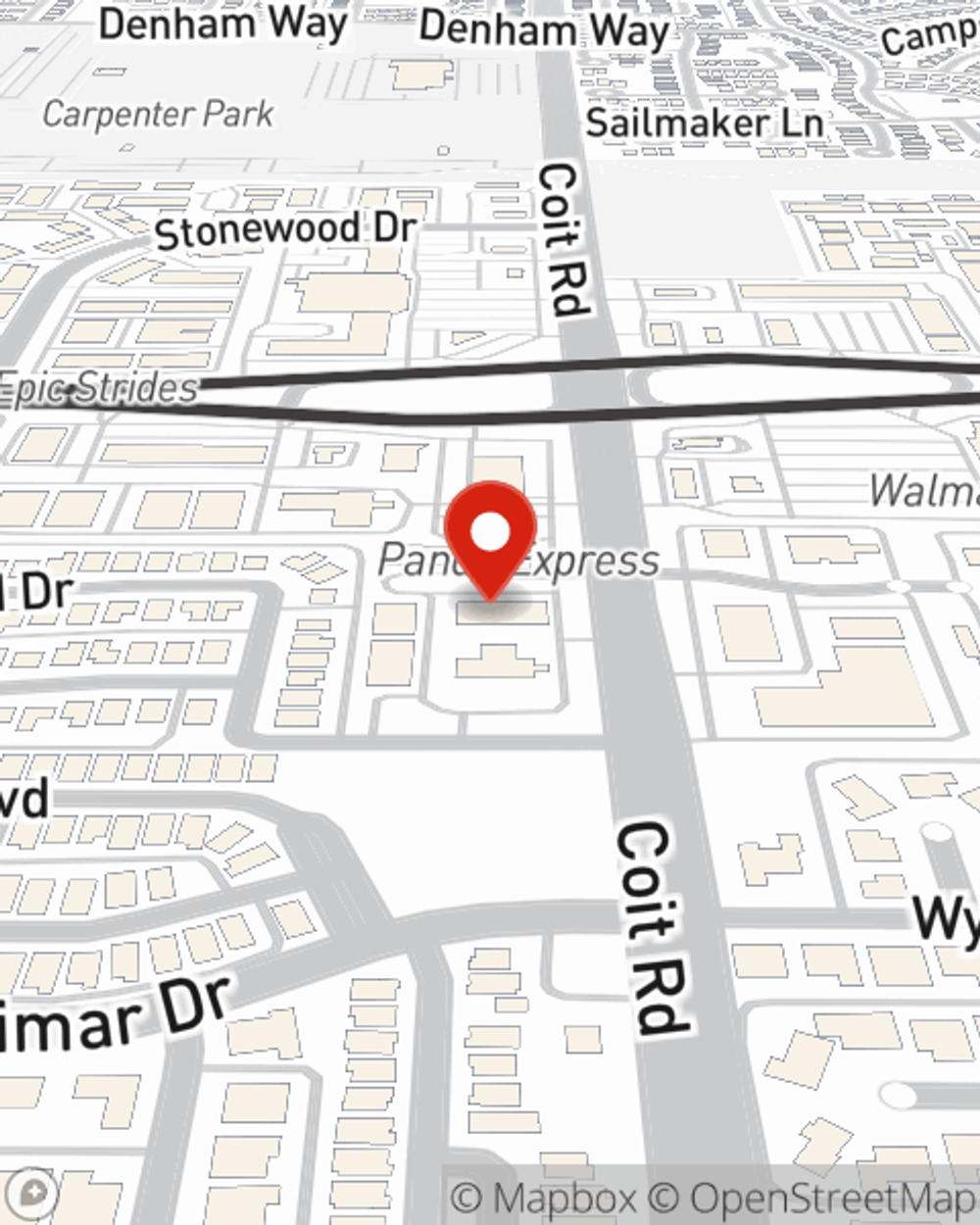

Chelsea Terry

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.